Adding hard cash on to your account. Bear in mind contributions are topic to once-a-year IRA contribution limits set through the IRS.

Due to this fact, they have a tendency not to promote self-directed IRAs, which supply the flexibleness to invest in a broader range of assets.

Making quite possibly the most of tax-advantaged accounts permits you to retain more of the money which you commit and receive. Based upon whether or not you select a conventional self-directed IRA or a self-directed Roth IRA, you have the prospective for tax-cost-free or tax-deferred advancement, provided certain disorders are fulfilled.

This facts provided by Charles Schwab Company here is for typical informational uses only, and is not meant to be considered a substitute for specific individualized tax, authorized, or investment planning guidance.

Unlike stocks and bonds, alternative assets are often harder to offer or can feature rigid contracts and schedules.

Often, the fees connected to SDIRAs could be higher plus much more sophisticated than with an everyday IRA. This is due to from the amplified complexity affiliated with administering the account.

In case you’re looking for a ‘set and fail to remember’ investing system, an SDIRA probably isn’t the correct alternative. As you are in full control more than each and every investment manufactured, It can be your decision to carry out your own homework. Don't forget, SDIRA custodians will not be fiduciaries and cannot make suggestions about investments.

Larger Fees: SDIRAs normally have better administrative charges compared to other IRAs, as sure areas of the administrative procedure can not be automated.

Of course, property is among our clientele’ most popular investments, from time to time referred to as a real estate IRA. Purchasers have the option to take a position in everything from rental Houses, commercial housing, undeveloped land, house loan notes plus much more.

Just before opening an SDIRA, it’s crucial that you weigh the prospective advantages and drawbacks determined by your particular money plans and chance tolerance.

The primary SDIRA policies with the IRS that traders have to have to know are investment limitations, disqualified individuals, and prohibited transactions. Account holders have to abide by SDIRA regulations and restrictions so that you can maintain the tax-advantaged standing of their account.

Have the freedom to invest in almost any sort of asset which has a hazard profile that matches your investment approach; which includes assets that have the potential for the next amount of return.

A self-directed IRA is surely an unbelievably potent investment motor vehicle, nonetheless it’s not for everyone. Given that the declaring goes: with great electric power comes wonderful responsibility; and using an SDIRA, that couldn’t be more real. Continue reading to find out why an SDIRA could, or might not, be to suit your needs.

Real estate is among the preferred possibilities amid SDIRA holders. That’s due to the fact it is possible to invest in any sort of real-estate which has a self-directed IRA.

As an investor, even so, your choices are not limited to stocks and bonds if you choose to self-immediate your retirement accounts. That’s why an SDIRA can remodel your portfolio.

IRAs held at banks and brokerage firms present limited investment possibilities for their clients simply because they do not have the experience or infrastructure to administer alternative assets.

Although there are plenty of benefits have a peek here connected with an SDIRA, it’s not without its possess disadvantages. A number of the prevalent main reasons why traders don’t pick SDIRAs incorporate:

Complexity and Duty: By having an SDIRA, you've additional Handle about your investments, but Additionally you bear additional obligation.

Higher investment selections means you can diversify your portfolio over and above stocks, bonds, and mutual money and hedge your portfolio from sector you can try here fluctuations and volatility.

No, You can not invest in your own private organization having a self-directed IRA. The IRS prohibits any transactions concerning your IRA along with your personal small business because you, as being the operator, are regarded as a disqualified man or woman.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Brooke Shields Then & Now!

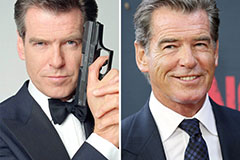

Brooke Shields Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!